In today’s economic climate you often can’t escape hearing about money in some form or another, particularly when you consider the amount of cuts that the performing arts industry has faced.

“Of the £700bn the government spends, the Department for Media, Culture & Sport’s budget is a minuscule £2.2bn, and [is] already suffering a 43% cut. The Arts Council has lost a third of its funds, [and have been] obliged to cut deep. Until now it has swallowed hard, and axed some projects altogether while investing selectively in the best” (Toynbee, 2013).

In the face of this it has never been more fundamental for a company’s financial planning to be well thought out, in order to adequately navigate the turbulent times the arts industry now finds itself in.

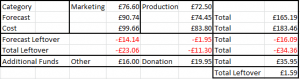

It is said that “the first step to effectively managing your finances is to see what kind of financial shape you’re currently in. And the first step to determining that is to get organized” (Schrage, 2013), which will allow for the creation of a suitable budget that our company will be able to follow throughout the creation of our debut performance. Our company has been given a donation of £166 from the University of Lincoln which we will have to carefully monitor in order to create our performance, Take Me by the Tongue. When creating a budget it is suggested that you collect every financial statement, record all monthly income, review your monthly expenditure and then make a list of fixed and variable expenses (fixed expenses remain the same throughout the months and variable expenses are likely to change from month to month)(Vohwinkle, 2014). However, this is more easily applied when you are creating a budget for personal finance as opposed to creating a budget for a drama production. Also, in the case of our company, we have no previous experience with which to draw upon in order to form our budget as this is our debut performance.

At the beginning of our project, Take Me by the Tongue, the company met to discuss what we wanted our debut performance to be, and decided that we wanted create a devised piece of theatre which brought further challenges when it came to creating a suitable budget for the show. For example, I couldn’t have a list of props that we would need for the performance, research how much they would cost and assign a specific amount of money for that area, because we weren’t completely aware of what we need. Therefore based on the conversations that we had as a company, I tried to split our funds in a sensible manner.

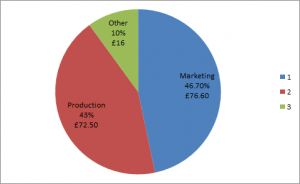

This graph shows the divisions that I made to the overall budget, and exactly what percentages I’ve assigned to each section. In our initial discussion regarding our performance it seemed that most of our ideas for prop, costume and set design would be quite simplistic, in order to give a contemporary feel which is why I felt that I was able to divide the money up in this manner. A lot of the props, costume ect, that have been mentioned up until this point will be easily accessible to us from the Lincoln Performing Arts Centre, or can be cheaply sourced.

As we went through the process of creating our show there were some hiccups that we had to cover financially, for example the first logo that we paid for we received feedback that suggested we make some changes, which obviously cost money. In order to try and prepare for unseen costs, I had set aside a small percentage of our budget so that we could prepared, and only allowed that portion of the budget to be spent when we needed something on show day. Also, as a result of our acoustic night, we received £19.95 in donations which, though it doesn’t seem like a lot, turned out to be the exact amount of extra money that we needed to purchase a few of our smaller props.

The money that was donated on the acoustic night was helpful though the purpose of the acoustic night was for promotional purposes as opposed to fundraising, although donations were welcome. This was because we felt that the focus of the night would better serve our company as a promotional technique because we knew at the time if we needed any extra money to cushion out our budget we wouldn’t need a lot. That being said, had we reached a point where we felt the show needed a substantial amount of extra funds then we were prepared to hold fundraising events in order to raise that money.

It has been said that budgeting and financial planning is much like the recipe for baking a cake;

“If you are going to bake a cake from scratch, you’ll probably want to use a recipe to ensure it bakes properly and tastes delicious… Your personal finances aren’t much different. Your income is the sum of ingredients, and your expenses are the quantities to use, while the budget tells you how to put it all together. With a cake recipe, if you’re short an egg or put in too much flower, the cake will not taste right or even bake properly at all. The same goes for your finances” (Vohwinkle, 2014).

I think in our case planning has been an essential part to our recipe; we were able to spend wisely and remain on budget and I’ve also been able to learn a lot about how I would handle the budget for future performances. We would carefully allocate any money that we would receive from funders like the arts council (see “Forward Thinking” by producer Lizzy Hayes) and would have fundraising plans in place in case we needed to raise any money. Planning is key, and hopefully by remaining wise in our spending we will be able to successfully manage our funds for future performances, enabling us to create more of the work that we have enjoyed, and that our audiences will enjoy like, Take Me by the Tongue.

Works Cited:

Schrage, Andrew (2013). How to Create an Organizational System for Your Finances. http://financialplan.about.com/b/2013/06/06/create-organizational-system-finances.htm [last accessed 29th/06/2014]

Vohwinkle, Jeremy (2014) Budget Isn’t a Bad Word. http://financialplan.about.com/od/budgetingyourmoney/a/budgetbad.htm [last accessed 1/06/2014]

Vohwinkle, Jeremy (2014) How To Create a Budget. http://financialplan.about.com/od/budgetingyourmoney/ht/createbudget.htm [last accessed 1/06/2014]